-

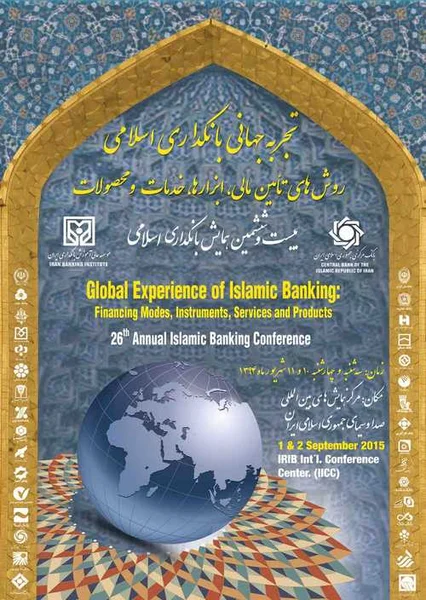

on the growth and stability of risk sharing based islamic finance

جزئیات بیشتر مقاله- تاریخ ارائه: 1395/07/01

- تاریخ انتشار در تی پی بین: 1395/07/01

- تعداد بازدید: 350

- تعداد پرسش و پاسخ ها: 0

- شماره تماس دبیرخانه رویداد: -

evidence has been mounting that the interest-based debt financing regime is under increasing distress. evidence also suggests that the financial crises, whatever title they carried-exchange rate crisis or banking crisis – have been debt related crises in essence. at present, data suggest that the debt-to-gdp ratio of the richest members of the g-20 is expected to reach 120% mark by 2014. there is also evidence that out of securities worth us$ 200 trillion in the global economy, no less than three-fourth represent interest-based debt. it is difficult to see how this massive debt volume can be validated by the underlying productive capacity of the global economy. this picture becomes more alarming considering the anemic state of global economic growth. there is great uncertainty with regard to interest rates. although policy-driven interest rates are near-zero level, there is no assurance that they will not rise as the risk and inflation premia become significant. hence, a more serious financial crisis may be in the offing and a general collapse of asset prices may occur. this paper argues that the survival of the interest-based debt regime is becoming less tenable, as is the process of financialization that has accompanied the growth of global finance over the last four decades. the above has resulted in an unprecedented increase in economic risks; generating (adverse) non-linearities in system‘s behavior. such a behavior is nothing but a demonstration of the verse,”allah obliterates riba ….” of the quran. as a result, the search is on for a paradigm shift towards a less volatile and more resilient financing regime. the paper proposes risk sharing based islamic financing as suitable alternative and also demonstrates empirically its better growth and stability characteristics by using advanced dynamic heterogeneous panel techniques.

مقالات جدیدترین رویدادها

-

استفاده از تحلیل اهمیت-عملکرد در ارائه الگوی مدیریت خلاقیت سازمانی و ارائه راهکار جهت بهبود

-

بررسی تاثیر ارزش وجوه نقد مازاد بر ساختار سرمایه شرکت های پذیرفته شده در بورس اوراق بهادار تهران

-

بررسی تأثیر سطح افشای ریسک بر قرارداد بدهی شرکت های پذیرفته شده در بورس اوراق بهادار تهران

-

بررسی تأثیر رتبه بندی اعتباری مبتنی بر مدل امتیاز بازار نوظهور بر نقد شوندگی سهام با تأکید بر خصوصی سازی شرکت ها

-

تأثیر آمیخته بازاریابی پوشاک ایرانی بر تصویر ذهنی مشتری پوشاک ایرانی (هاکوپیان)

-

مدیریت بسته بندی کالا و نقش آن در برندسازی

-

نظر والدین، پزشکان و پرستاران بخش مراقبت های ویژه کودکان نسبت به حضور والدین در زمان احیای کودک

-

to investigate the effect of long-term storage on the physicochemical properties of honey

-

steam cracking of naphtha in a novel reactor

-

fabrication and optical properties of silica shell photonic crystals

مقالات جدیدترین ژورنال ها

-

مدیریت و بررسی افسردگی دانش آموزان دختر مقطع متوسطه دوم در دروان کرونا در شهرستان دزفول

-

مدیریت و بررسی خرد سیاسی در اندیشه ی فردوسی در ادب ایران

-

واکاوی و مدیریت توصیفی قلمدان(جاکلیدی)ضریح در موزه آستان قدس رضوی

-

بررسی تاثیر خلاقیت، دانش و انگیزه کارکنان بر پیشنهادات نوآورانه کارکنان ( مورد مطالعه: هتل های 3 و 4 ستاره استان کرمان)

-

بررسی تاثیر کیفیت سیستم های اطلاعاتی بر تصمیم گیری موفق در شرکتهای تولیدی استان اصفهان (مورد مطالعه: مدیران شرکتهای تولیدی استان اصفهان)

-

ارزیابی عوامل موثر بر پروژه توسعه اکوتوریسم مطالعه موردی شهر چالوس

-

سوبژکتیویته توده جامعه در انقلاب ایران در آرای دوتوکویل و میشل فوکو

-

تبیین شاخص های شهر خلاق در خیابان ابوطالب مشهد با استفاده از مدل ahp

-

ارزیابی نگرش، دانش و رفتار محیط زیستی بازدیدکنندگان در پارک جنگلی النگ دره گرگان

-

the timber floor seismic design by means finite element method

سوال خود را در مورد این مقاله مطرح نمایید :