-

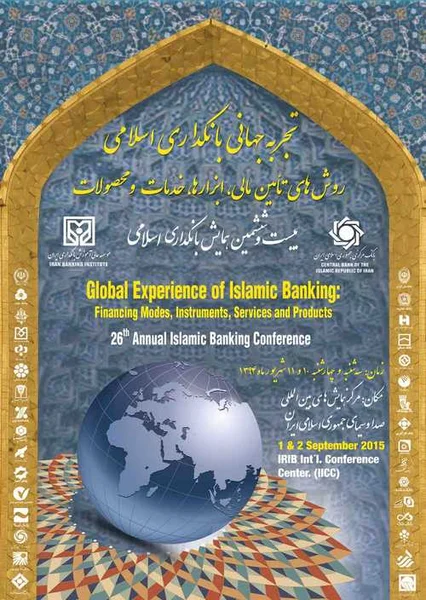

a risk sharing banking model

جزئیات بیشتر مقاله- تاریخ ارائه: 1395/07/01

- تاریخ انتشار در تی پی بین: 1395/07/01

- تعداد بازدید: 421

- تعداد پرسش و پاسخ ها: 0

- شماره تماس دبیرخانه رویداد: -

islamic banking has thus far mimicked conventional banking with the result that the same problems and outcomes have surfaced, even though it is operating within an interest free framework. this apparent “convergence” has led to disaffection both among consumers of islamic banking services and policy makers. this paper proposes a risk sharing model for islamic banks that can potentially pull islamic banking away from this path dependency. under the proposal an islamic bank‟s assets would be securitized by the issuance of sukuk type instruments that have the same underlying contract and average “duration” as customer financing. small assets may have to be pooled into tranches of similar maturity before being securitized. medium and larger assets would have papers issued directly against them. thus, instead of depositors, an islamic bank would have thousands of sukuk holders, all of whom share the profits and losses arising from their respective tagged asset. other than wadiah based safe custody accounts and current accounts against which the bank holds cash, all other depositors would be “sold” sukuk for the amount, duration and risk level that they prefer. the model has several advantages such as, minimizing systemic risk through risk dissipation and reducing the liquidity mismatch inherent to banking. the securitized papers provide new liquidity instruments and can enhance liquidity within the islamic finance sector. where the macro economy is concerned, the proposal enhances system stability by reducing risk concentration within the banking system, substantially wideming financial inclusion by way of small denomination sukuk and minimizes the contingent liabilities of governments by avoiding the use of deposit insurance.

مقالات جدیدترین رویدادها

-

استفاده از تحلیل اهمیت-عملکرد در ارائه الگوی مدیریت خلاقیت سازمانی و ارائه راهکار جهت بهبود

-

بررسی تاثیر ارزش وجوه نقد مازاد بر ساختار سرمایه شرکت های پذیرفته شده در بورس اوراق بهادار تهران

-

بررسی تأثیر سطح افشای ریسک بر قرارداد بدهی شرکت های پذیرفته شده در بورس اوراق بهادار تهران

-

بررسی تأثیر رتبه بندی اعتباری مبتنی بر مدل امتیاز بازار نوظهور بر نقد شوندگی سهام با تأکید بر خصوصی سازی شرکت ها

-

تأثیر آمیخته بازاریابی پوشاک ایرانی بر تصویر ذهنی مشتری پوشاک ایرانی (هاکوپیان)

-

critic on typology of ceiling of amir inn and arch in tabriz bazaar & complex shaking resistance evaluation

-

تعیین ارزش زمان سفر با استفاده از روش ترجیحات بیان شده مطالعه موردی: شهر تهران

-

بررسی مؤلفه های تأثیر گذار در تحلیل هویت شهری

-

گزارش یک مورد سندرم آلبرایت

-

مقایسه مفهوم ارتباط درون و بیرون در ایران و جهان از دیدگاه کریستیان نوربرگ شولتز

مقالات جدیدترین ژورنال ها

-

مدیریت و بررسی افسردگی دانش آموزان دختر مقطع متوسطه دوم در دروان کرونا در شهرستان دزفول

-

مدیریت و بررسی خرد سیاسی در اندیشه ی فردوسی در ادب ایران

-

واکاوی و مدیریت توصیفی قلمدان(جاکلیدی)ضریح در موزه آستان قدس رضوی

-

بررسی تاثیر خلاقیت، دانش و انگیزه کارکنان بر پیشنهادات نوآورانه کارکنان ( مورد مطالعه: هتل های 3 و 4 ستاره استان کرمان)

-

بررسی تاثیر کیفیت سیستم های اطلاعاتی بر تصمیم گیری موفق در شرکتهای تولیدی استان اصفهان (مورد مطالعه: مدیران شرکتهای تولیدی استان اصفهان)

-

روانشناسی قانونی: ضرورتی در نظام عدالت کیفری ایران

-

تدوین مدل معادلات ساختاری اهمال کاری بر اساس سرمایه روان شناختی (امید، خوش بینی، تاب آوری و خودکارآمدی) با اثر تعدیل کنندگی تفکر انتقادی

-

بررسی رابطه بین سبکهای مدیریت مدیران با سلامت سازمانی و عملکرد شغلی کارکنان (اداره کل بنادر و دریانوردی استان خوزستان منطقه ویژه بندر امام خمینی)

-

بررسی اصل عدم با اصل استصحاب

-

تاثیر ویژگی مدیریتی ( خودشیفتگی، توانایی مدیر ) بر کنترل حسابرسی داخلی با تاکید بر نقش سیستم های حسابداری مدیریت

سوال خود را در مورد این مقاله مطرح نمایید :